🚘 Internal combustion engine car sales peaked in 2017

Global auto sales rebound, but internal combustion engine (ICE) vehicles may never return to pre-pandemic levels. Electric vehicle adoption is accelerating in China, Europe, and the US, indicating a significant shift toward a sustainable future.

Share this story!

As the world emerges from the pandemic, there are increasing signs that global auto sales are rebounding.

However, it is becoming apparent that sales of internal combustion engine (ICE) vehicles may never return to pre-pandemic levels, indicating a significant shift in the automotive market.

Decline in internal combustion vehicle sales

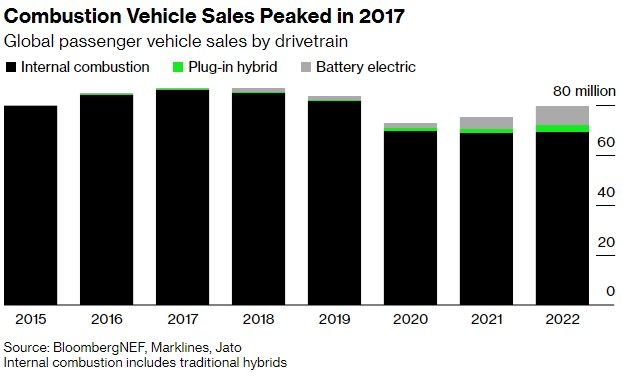

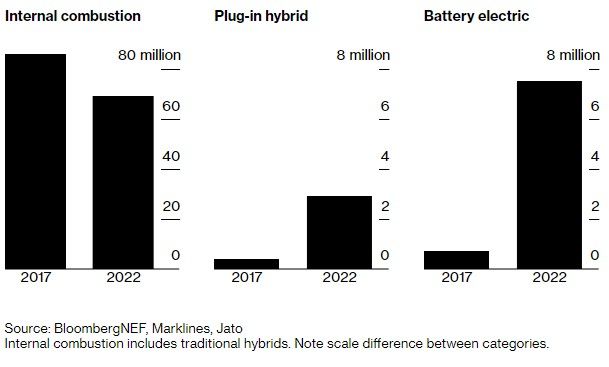

BNEF, with 2022 data now available, confidently states that the global market for ICE vehicles peaked in 2017 and has since entered a structural decline.

This may come as a surprise to some, as oil demand forecasts from a few years ago assumed steady growth in ICE vehicle sales well into the 2030s.

The changing landscape of vehicle sales

In 2017, 86 million ICE passenger vehicles were sold, with battery-electric and plug-in hybrid models accounting for a mere 1 million vehicles.

However, 2022 saw a drastically different picture, with ICE vehicle sales dropping by nearly 20 percent to 69 million and plug-in vehicles skyrocketing to 10.4 million.

China and Europe embrace electric vehicles

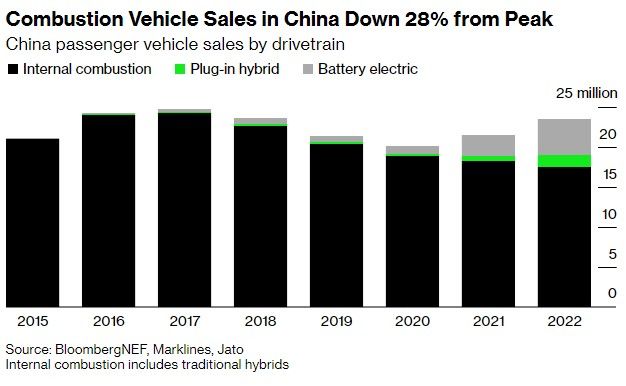

The trend is even more pronounced in China, where plug-in vehicles accounted for 26 percent of vehicle sales in 2022.

BNEF expects this figure to rise to around a third of all passenger vehicles sold in China in 2023. Europe also mirrors this trend, with a significant drop in ICE vehicle sales.

US electric vehicle market set for growth

In the United States, electric vehicle (EV) sales are expected to have a breakout year, backed by the Inflation Reduction Act.

Emerging economies and electric vehicle adoption

While there is a noticeable gap in EV adoption between wealthy and emerging economies, it is unlikely that this would result in growth in ICE vehicle sales. Southeast Asia's expanding car market is increasingly being occupied by EVs, with countries like Thailand and Indonesia becoming hubs for battery and EV production.

India's electric vehicle ambitions

India is another emerging market embracing EVs, with sales increasing from 15,000 in 2021 to almost 50,000 in 2022. BNEF predicts this strong growth to continue in 2023.

Stagnant new-vehicle sales in Brazil and Mexico

New-vehicle sales in Brazil and Mexico remain largely flat, and Africa's numbers are still minimal. While ICE vehicle sales may see a slight gain in 2023, they will not come close to the 2017 peak.

Global combustion vehicle fleet set to decline

BNEF estimates that the global ICE vehicle fleet will remain relatively steady for the next three years before starting to decline from 2026 onward as the EV fleet expands.

Implications for oil demand and emissions

With the fleet transition, reversing the trend will be nearly impossible, impacting oil demand and emissions. BNEF's models project that overall oil demand from road transport will peak in 2027, just four years away.

Trucks represent the next major market shift, with 7 percent of all commercial vehicle sales in China being electric in 2022 and heavy truck sales reaching a 5 percent EV share in December.

As ICE vehicle sales decline, other market peaks are soon to follow, marking a global shift towards electric vehicles and a more sustainable future.

The speed of this transition is likely to accelerate in the coming years, when electric vehicles both become cheaper to own (already true) and cheaper to buy (soon a reality.)

Read more in our Optimist's Edge:

Mathias Sundin

The Angry Optimist

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.