🔋 Come on, Northvolt is not a pipe dream, and batteries are not a green bubble

Is Northvolt a pipe dream? asked the reporter. That was when I realized this wasn't a serious investigation, but a witch hunt. Let’s scrutinize this absurd claim.

Share this story!

It was when I read this question from a reporter, that I understood that the investigation of the battery manufacturer Northvolt was not an investigation. It was a witch hunt. A situation where common sense and reason leave the media as they smell blood and egg each other on.

The question that made this clear to me was posed by the Swedish business newspaper, Dagens industry, to Peter Carlsson, founder and CEO of Northvolt.

Is Northvolt a pipe dream? asked the reporter from Dagens industri.

A pipe dream?! Something without substance. An inflated dream lacking any basis in reality. Some call it a green bubble.

For it to be a pipe dream and a green bubble, the battery industry would have to lack substance, and Northvolt would have to be a Potemkin village. Let’s examine both of these aspects.

A green growing industry

Let’s start with the most fundamental: The world needs to transition from fossil energy production and fossil fuels to something else. This "something else" in energy production seems to be nuclear power, wind power, and solar power for production, and electric vehicles for transport.

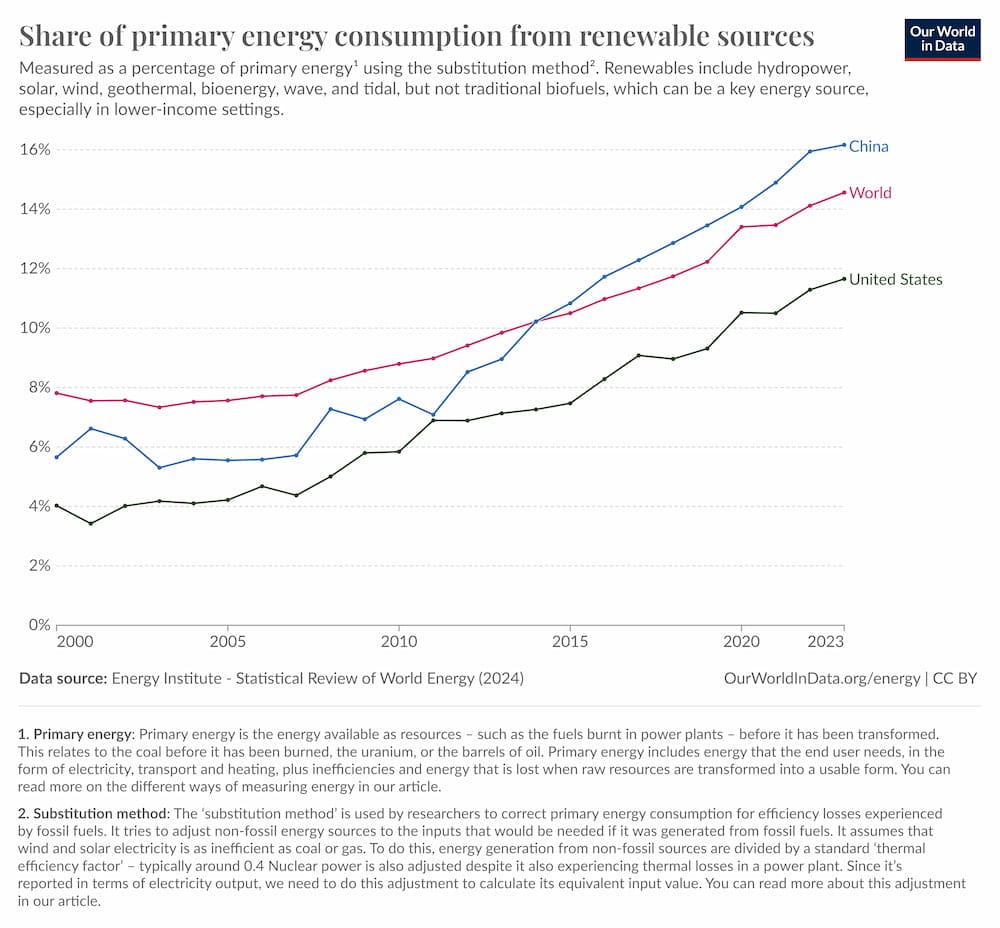

We are seeing massive growth in solar and wind. Last year, a 50 percent increase. They still make up a small part of the total, but it is increasing rapidly. The U.S. has nearly tripled its share during the 21st century, the world has doubled, and China has more than doubled.

What suggests that this will continue is the price, which is dropping. The cost of solar cells decreased by 50 percent last year. The price of solar energy fell 90 percent during the 2010s and continues to decrease.

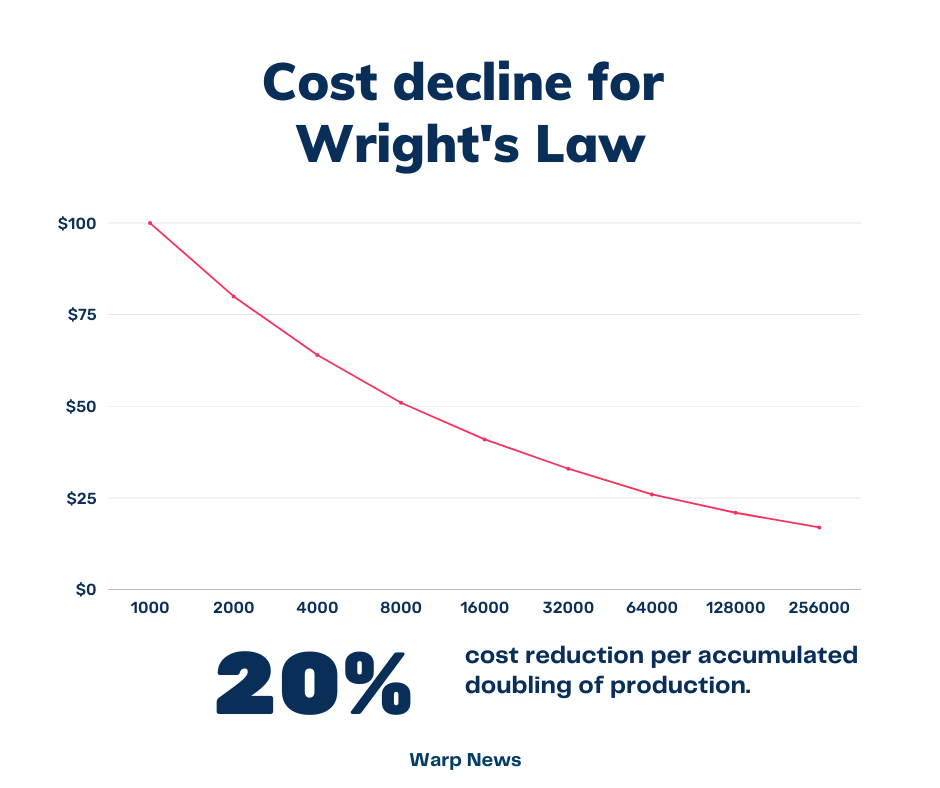

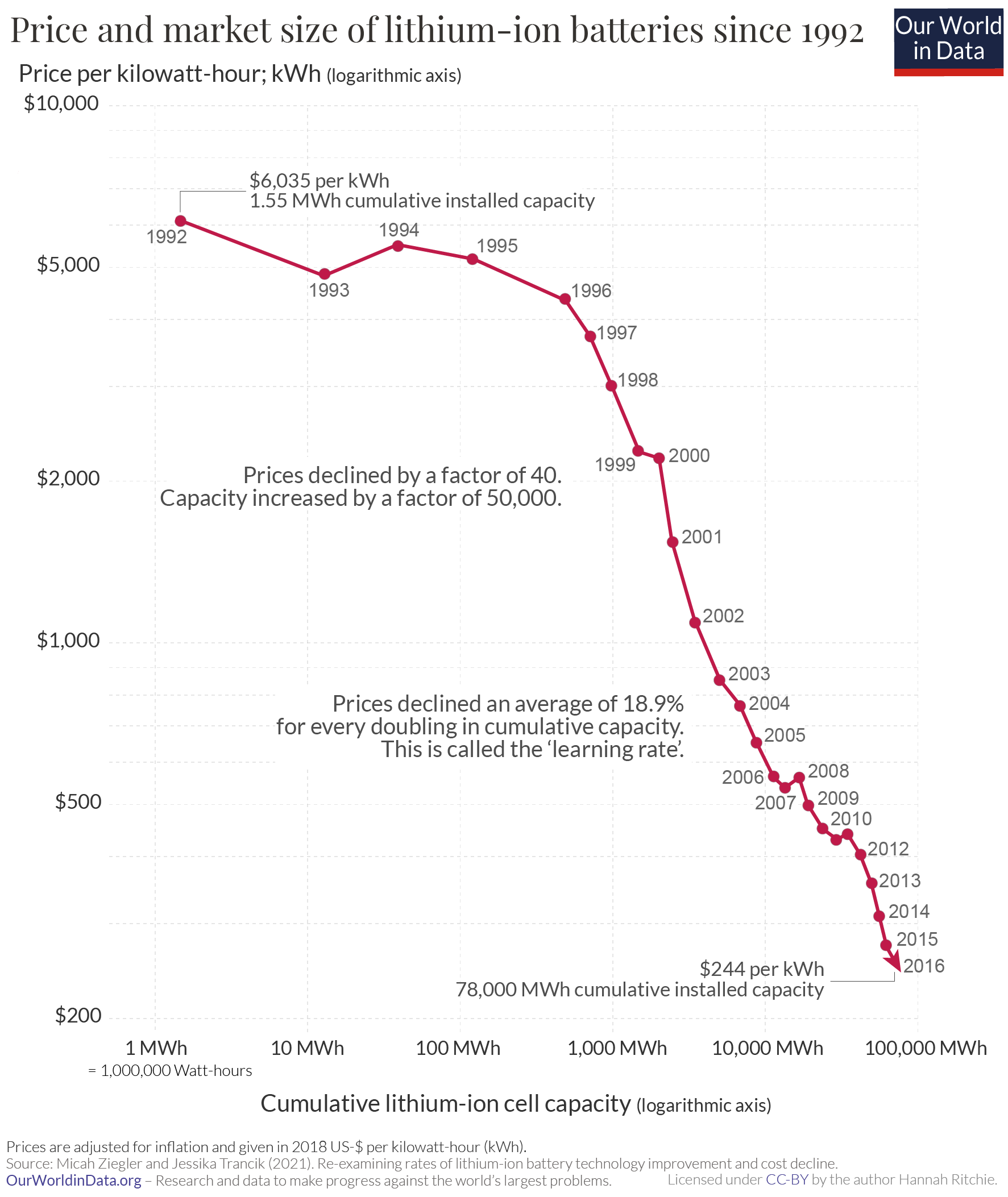

This is not by chance but is based on Wright's law, or the learning curve. Wright's law is a rule of thumb that says when the total production of a product doubles, the cost to manufacture the product drops by about 20 percent. According to MIT, this rule of thumb is the most accurate for predicting price trends.

As the production of solar cells and wind turbines increases dramatically, these doublings occur often, causing prices to drop quickly. This makes it increasingly profitable to invest in solar and wind, more installations are built, and the price drops even further.

A key factor in this is mass production. This is why we have not seen a similar price trend for nuclear power. Perhaps we could achieve this with small modular reactors, but we’re not there yet. However, nuclear power has gained increased support among many voters and from politicians.

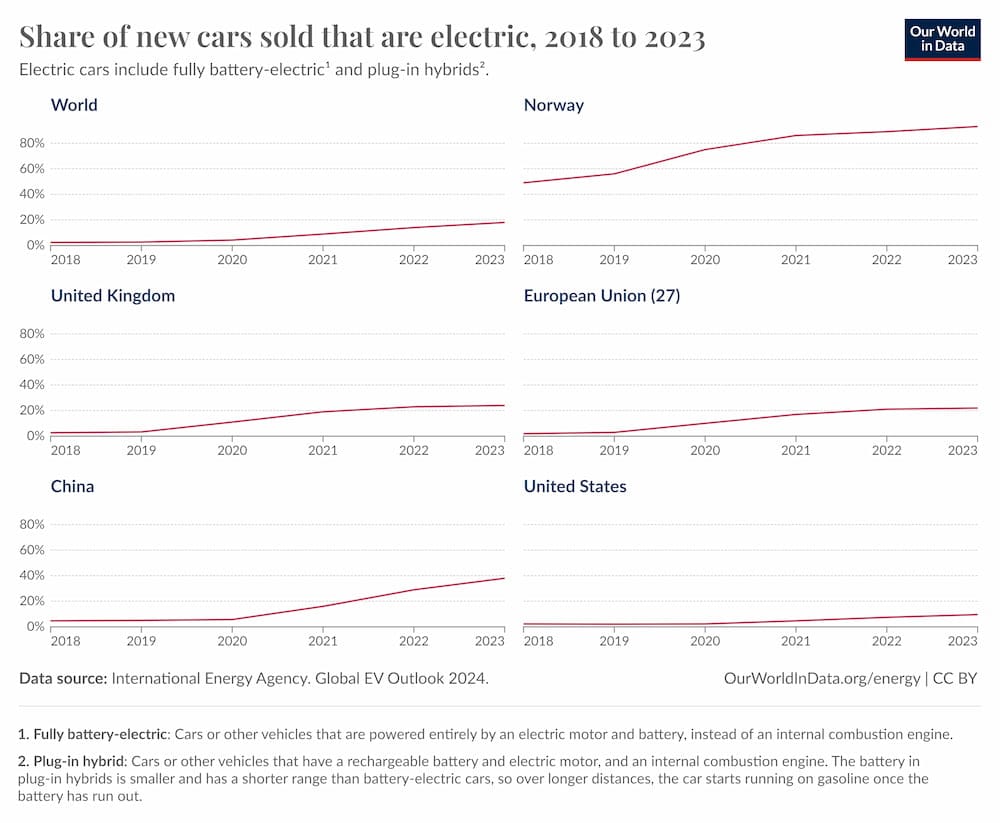

Electric vehicles, primarily electric cars, are increasing even faster. In 2020, four percent of all new cars globally were electric vehicles. In 2023, it was 18 percent. The EU has gone from 10 to 22 percent, and China from 6 to 38 percent. The U.S. lags behind but has doubled from 5 to 10 percent.

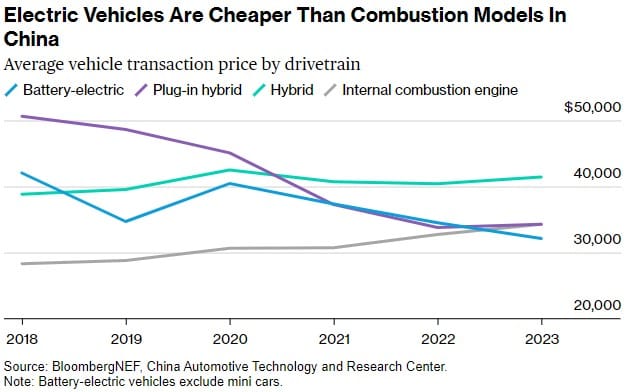

Here, too, we see the effect of Wright's law. The price of electric cars is falling rapidly. Not least because the large lithium-ion batteries in the cars also follow Wright's law and are becoming cheaper quickly—over 90 percent cheaper since 2010 and down 51 percent in the last year.

In several categories, electric cars are already cheaper to buy than their fossil-fuel counterparts, and prices will continue to drop, while range increases and the charging infrastructure expands.

The cost reduction makes it more profitable to store energy from solar and wind in batteries, and thus we see a sharp increase in such energy storage—75 percent increase in 2022 and a tripling last year.

So to summarize: A positive spiral of increased production of solar, wind, batteries, and electric vehicles leads to lower prices for customers, resulting in more orders, increased production, even lower costs, and so on. We have both an economic drive and a need for climate transition working together.

Does that sound like a green bubble? Green it is, but not a bubble. Since we need to phase out all coal and oil and all fossil vehicles, the remaining market is enormous. The two industries (energy and automotive) generate several trillion dollars every year, and the share for renewables, electricity, and batteries will go from 10-15 percent of the market to at least 70-80 percent.

If one argues that this won’t happen, they would need a very good explanation of what will replace fossil energy production and fossil fuels instead. The alternatives aren’t even on the horizon.

No pipe dream

Now to the company Northvolt.

Founder Peter Carlsson saw this development early on. He worked with lithium-ion batteries in the early 2000s, back then in Sony Ericsson's mobile phones. From there, he was recruited to Tesla and was involved when ground was broken for their first battery factory, Gigafactory in Nevada.

When investors saw the opportunity and car companies saw the threat, they started looking for companies to invest in. Peter Carlsson was part of a small group in the world who had exactly the knowledge investors sought. That’s why they have invested over 13 billion dollars in Northvolt.

These funds have been used to build a factory in Skellefteå, a lab in Västerås, start construction on two more factories in Gothenburg and Germany, hire 5,000 people, and also achieve a breakthrough in battery technology, among other things.

Does that sound like a pipe dream? A company that has rapidly gone from zero to an industrial giant in one of the world’s biggest business opportunities. I wasn't talking about Northvolt, but Tesla. A large, growing, and profitable company that stands on exactly the same foundation as Northvolt. If you call Northvolt a pipe dream, you have to call Tesla a pipe dream.

Northvolt may still fail

But just because batteries aren’t a green bubble and Northvolt isn’t a pipe dream doesn’t mean they lack problems. There is no guarantee that Northvolt will succeed. A challenge for all battery manufacturers is the rapidly falling price of batteries. When you have large investments in factories and development, while being able to charge less and less for your product, survival is hard.

The competition is also already fierce. Factory capacity is expanding rapidly, which also puts pressure on prices.

Moreover, it’s difficult to start a company. And incredibly difficult to build an industrial giant in a brand-new industry within a handful of years. Of course, sooner or later, you encounter major problems. Anything else would be a pipe dream. Northvolt seems to have had difficulty starting large-scale production, for example. Several people who have worked for or with Northvolt have also died. Whether this is due to Northvolt or something else is currently being investigated.

I have no inside knowledge of Northvolt. I don’t know how Peter Carlsson is as a CEO. Therefore, I don’t know if he will solve the problems Northvolt faces.

But I know we should be grateful that he happens to be from a democracy. Imagine if Northvolt manages to establish itself as one of the world’s largest battery manufacturers. How many jobs, how much growth, how much research funding, how much tax revenue, how much wealth will come from that?

That’s why we should hope Northvolt succeeds. Not cheer for failure.

There are many reasons for this. Besides climate, jobs, and growth, national security is another reason. A large part of the world’s battery production is in China. That’s a risk. We need successful European battery manufacturers. Northvolt is not just charging batteries, but also the economic future of Sweden and Europe.

Investigate, don’t incite

The media should, of course, investigate. Highlighting problems and negative aspects is not wrong. But there is a difference between an investigation and a witch hunt. An investigation is conducted on the knowledge base I’ve described above, about an important growth industry full of substance, where mistakes and problems are scrutinized but successes and opportunities are showcased with equally large headlines. What we’re seeing now is not an investigation. It’s a witch hunt.

Mathias Sundin

The Angry Optimist

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.