💰 Big ideas on how to make big money - investing in the future

A fact-based optimist sees opportunities before everyone else. One opportunity is to invest in companies that create a better world, and at the same time make a lot of money.

Share this story!

Premium Supporters - click here to listen to the audio of this text.

Optimist's Edge summarized

- The clearest cut business opportunity in the coming decade is autonomous ride-hailing. Without the cost of the driver, electricity instead of gasoline, and fast shrinking battery costs, the cost of transportation will go down significantly and open a new, enormous market.

- Deep learning means computers learn to write code and programming becomes automatic, faster and cheaper. That will drive faster progress in many areas.

Optimist's Edge in investing

By having the Optimist's Edge you can see and grab opportunities before the pessimists. One opportunity is to invest in companies that make the world a better place, and at the same time make a lot of money.

Picking the right companies is of course tricky, but it helps to understand exponential technologies and not listen to pessimists who believe stuff like "electric cars will always be to expensive."

In this article I'll share some of the highlights from the world's most successful investor in exponential technologies, ARK Invest.

There will be a lot of billions and trillions (1000 billions) thrown around, but behind the numbers lie excellent progress for humanity.

But first some background on Cathie Wood and ARK Invest.

ARK Invest and Cathie Wood

ARK Invest is an asset management company founded in 2014 by experienced Wall Street investor, Cathie Wood.

The idea behind ARK is to start with researching technologies, their progress, and convergence with other technologies. Based on that they try to pinpoint where the disruptions will happen.

They don't start with analyzing individual companies' financials, like many other investors, that comes later in the process.

Insane Tesla price target - that came true

ARK's claim to fame is Tesla. In 2018 they said that the Tesla stock could reach $4,000 in five years. At that time the price was about $300. At the time, ARK had about $5 billion under management.

Almost no one believed them, and many openly mocked them.

The Tesla stock was split 1:5 last year, so a $4000 price target is now $800. The stock price is now over $850, after a run of almost 700 percent in 2020. Now ARK has over $50 billion under management.

Picking one phenomenal stock doesn't make you an expert investor, but it's not just Tesla driving their success, and I think their general approach to investing is the right one. I've mentioned their research a couple of times in my Warp News articles (before the current ARK hype!)

Another good thing about ARK is that they share their ideas and research. Now they've just published their Big Ideas 2021 and here are the highlights from that report.

Deep learning could be the most important software breakthrough of our time

Until recently, humans programmed all software. Deep learning, a form of artificial intelligence uses data to write software.

By automating the creation of software, deep learning could turbocharge every industry.

Deep learning has created $2 trillion in market capitalization as of 2020, and ARK thinks it will add $30 trillion to the global equity market capitalization during the next 15-20 years. As a comparison, the Internet has so far added $13 trillion.

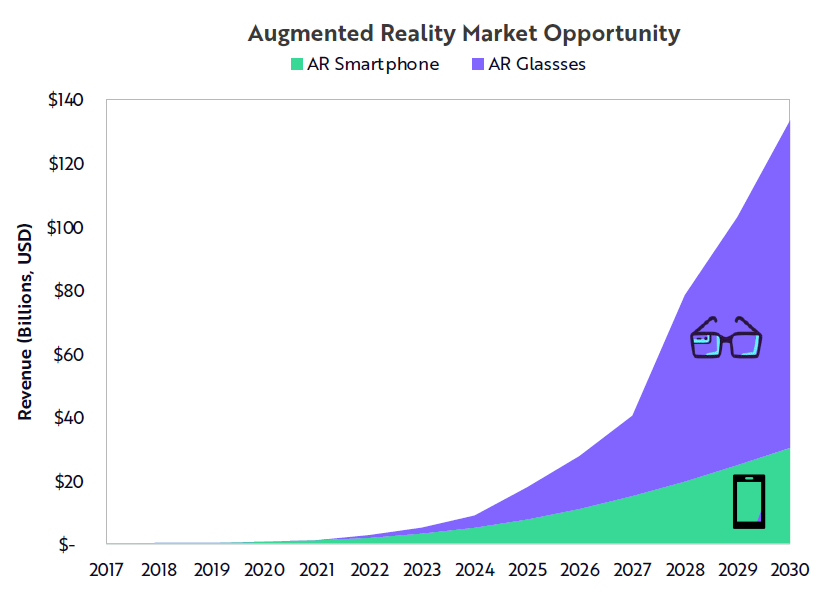

Augmented Reality is primed to scale

Over the past few years, companies such as Snapchat, Facebook, and Apple have increased their augmented reality investment.

By 2022, consumer-grade AR headsets should turbocharge this trend.

By 2030 the AR market could scale from under $1 billion today to $130 billion.

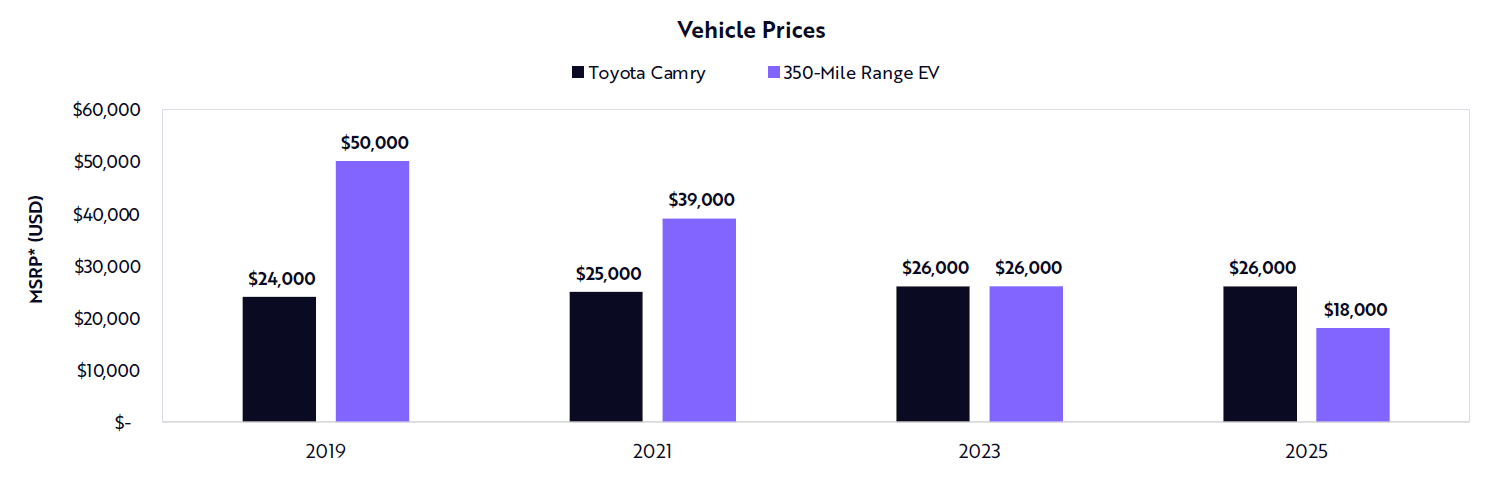

40 million EVs sold 2025

Electric vehicles are approaching sticker price parity with gas-powered cars.

According to Wright’s Law, for every cumulative doubling of units produced, battery cell costs will fall by 28%. The largest cost component of an EV is its battery so these cost declines are critical to reaching price parity with gas-powered vehicles.

EV sales should increase roughly 20-fold from ~2.2 million in 2020 to 40 million units in 2025.

The biggest downside risk is whether traditional automakers can make a successful transition to electric and autonomous vehicles.

The robots will create jobs

Fears abound that automation will destroy jobs, but ARK believes it will empower humans, increasing both productivity and wage growth.

Automation has the potential to shift unpaid labor to paid labor. For example, as food services automate, they will transform food prep, cleanup, and grocery shopping into market activities including food delivery.

Just like the washing machine freed up unpaid time spent cleaning clothes. Time that you could do something else with, for example, paid labor.

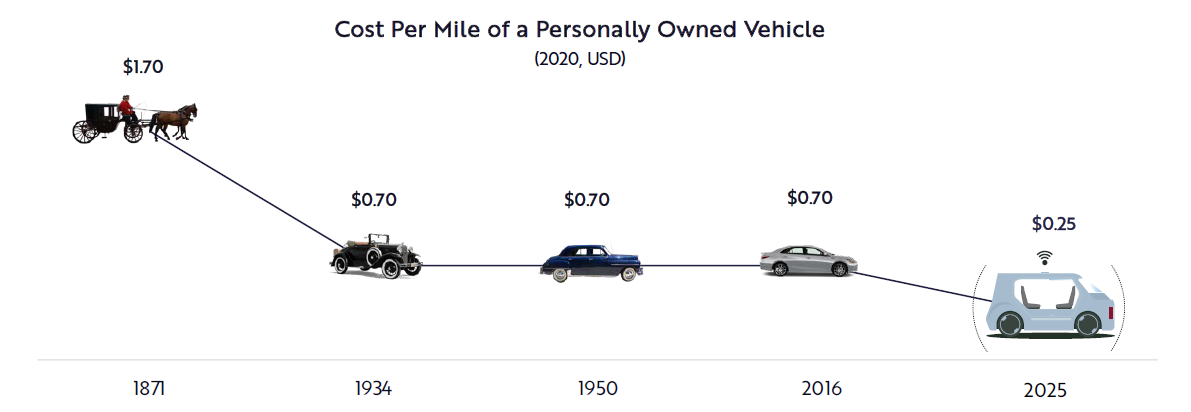

The mega opportunity: Autonomous ride-hailing

Autonomous ride-hailing (think Uber with self-driving cars and no drivers) will reduce the cost of mobility to one-tenth of taxi's average cost today.

Adjusted for inflation, the cost to own and operate a personal car has not changed since the Model T rolled off the first assembly line. This will change now.

The lower price point should expand the total market from $150 billion in revenues to $6-7 trillion by 2030.

Platform providers should garner the lion's share of autonomous ride-hailing profits.

ARK’s research suggests that autonomous ride-hailing platforms will generate more than $1 trillion in profits per year by 2030.

The space industry is taking off

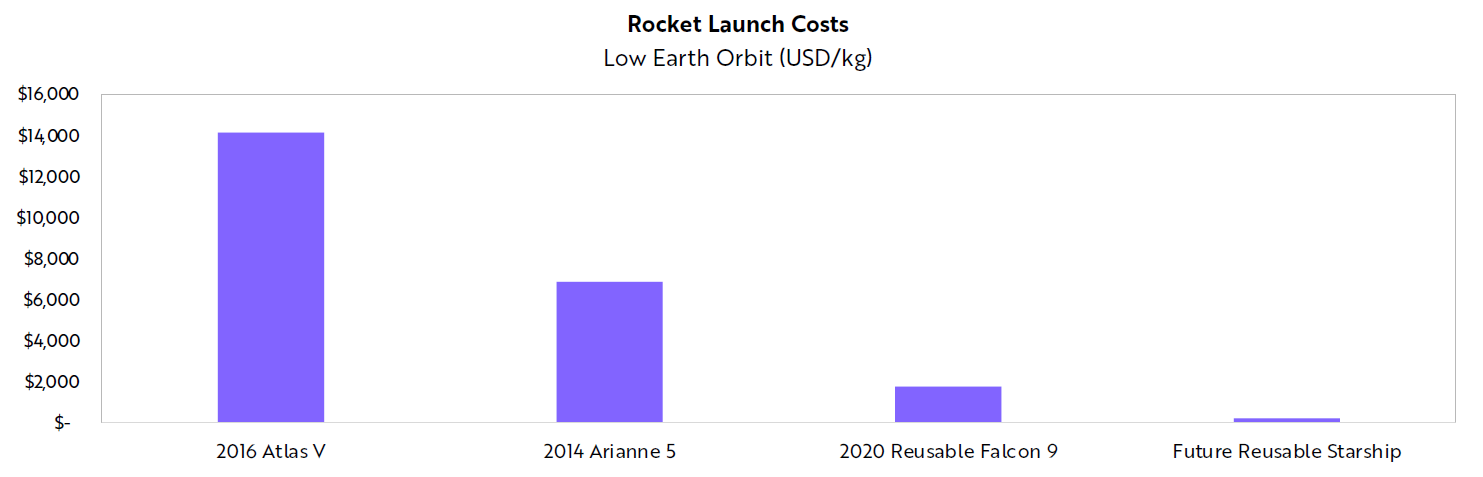

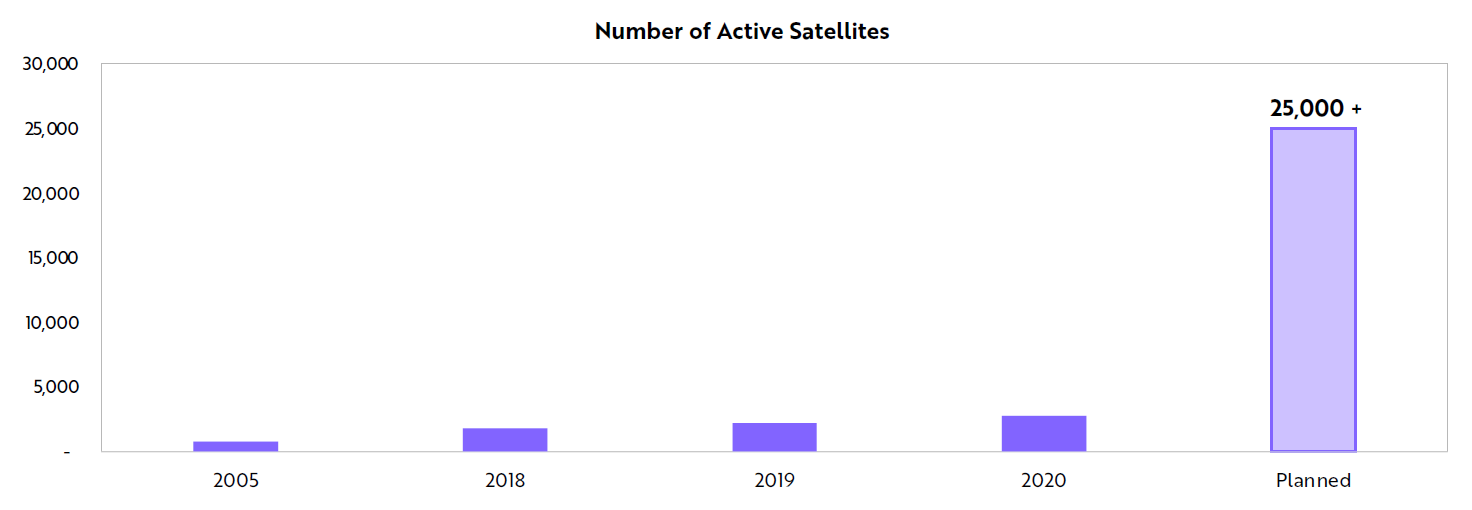

Thanks to advancements in deep learning, mobile connectivity, sensors, 3D printing, and robotics, costs that have been ballooning for decades are beginning to decline.

As a result, the number of satellite launches and rocket landings is proliferating.

Thanks to lower launch costs, the number of satellites scheduled for orbit has increased significantly.

In total, the satellite connectivity market could approach $100 billion annually over the medium term.

In total the orbital aerospace opportunity will exceed $370 billion annually in 2025.

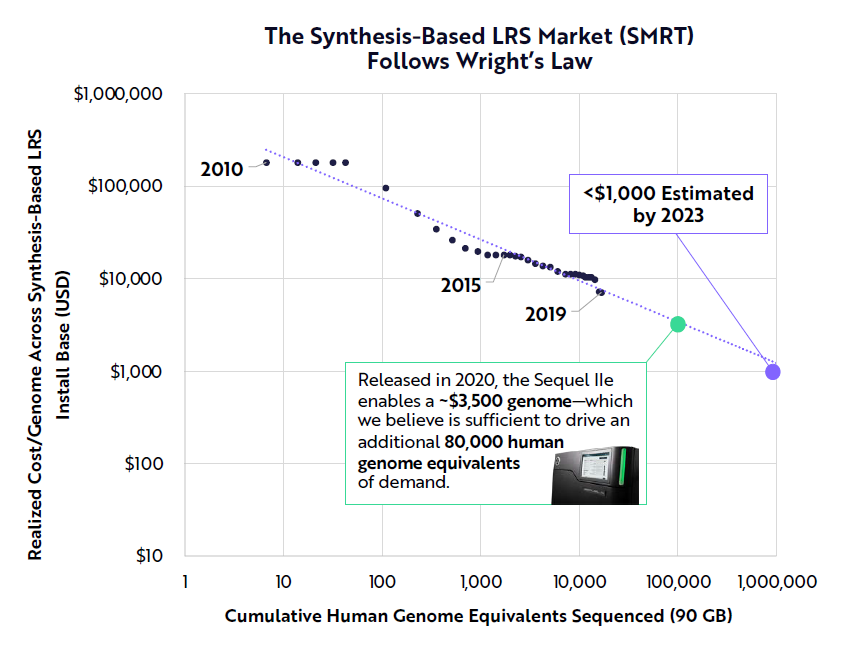

Long-Read Sequencing of the human genome

Next-generation DNA sequencing is the driving force behind the genomic revolution. Though historically dominated by shortread sequencing, we believe long-read sequencing will gain share at a rapid rate.

Long-read technology offers superior accuracy, more comprehensive variant detection, and a richer set of features than short-read platforms.

Long-read revenues will grow 82% at an annual rate, from $250 million in 2020 to roughly $5 billion in 2025.

If you find this interesting, I recommend you read the whole report.

Mathias Sundin

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.